SK specialty

Sustainability Strategy

ESG Promotion Strategy

SK Specialty is evolving into a leading ESG company in the global materials industry.

To this end, we set mid- to long-term goals in the areas of environment, society, and governance, and promote various activities.

Evolving into a company leading ESG agenda

in the global materials industry

-

Environmental

- Establishment of

a green workplace - Eco-friendly products

/services - Continuous

expansion

- Establishment of

-

Social

- Establishment of a safe and healthy workplace

- Sustainable supply chain management

- Co-prosperity with community

-

Governance

- Establishment of the management system

of the Board of Directors - Practice of ethical/compliance

management meeting the global standards

- Establishment of the management system

ESG Management Activities

Identifying Stakeholders’ ESG Needs

SK Specialty has established various channels to collect stakeholders’ needs on major issues and makes efforts to reflect them in its management activities. We reflect various stakeholders’ needs in the sustainable management report through a criticality assessment. Furthermore, we would like to reflect stakeholders’ needs not only in sustainable management information disclosure but also in business areas through in-depth interviews with stakeholders. At the end of 2021, we conducted in-depth interviews with 3 major partners, and from now on, we will further strive to identify the needs of more diverse stakeholders such as customers and communities.

Development and Expansion of Eco-friendly Materials/Technology

SK Specialty is focusing on the research and development of eco-friendly materials/technology that can contribute to

curtailing environmental impact of the workplace as well as reducing environmental impact of products.

-

Reducing the environmental impact of products by securing various CCUS technologies at home and abroad

-

Upcycling of waste resources in semiconductor factory

-

Securing eco-friendly raw materials

-

Developing low GWP eco-friendly cleaning gas

Management ESG Performance Assessment

SK Specialty evaluates ESG performance in order to put ESG management into practice, and reflects it in compensation. When setting performance goals, CEOs, executives, each organization and members set goals connected with ESG in a 20-50% ratio of the total. We also reflect social and governance tasks, such as implementation of Net-Zero(achieving carbon reduction targets) and RE100, climate change/green plant development tasks such as waste/water recycling and safety management, ESG risk management for partners, community support and strengthening the responsible management of the board of directors, in performance assessment to encourage ESG performance. For technical positions where SHE management is important, such as safety and environment, a higher level of SHE-related compensation system has been established. The achievement of ESG performance is reflected in the final assessment results and is used for incentive payments, etc. In 2022, ESG-linked tasks were expanded according to the roadmap for improving ESG performance assessment. From 2023, we plan to upgrade and expand the scope of the tasks reflected in performance assessment by area(climate change/diversity/supply chain, etc.) according to strengthened global guides.

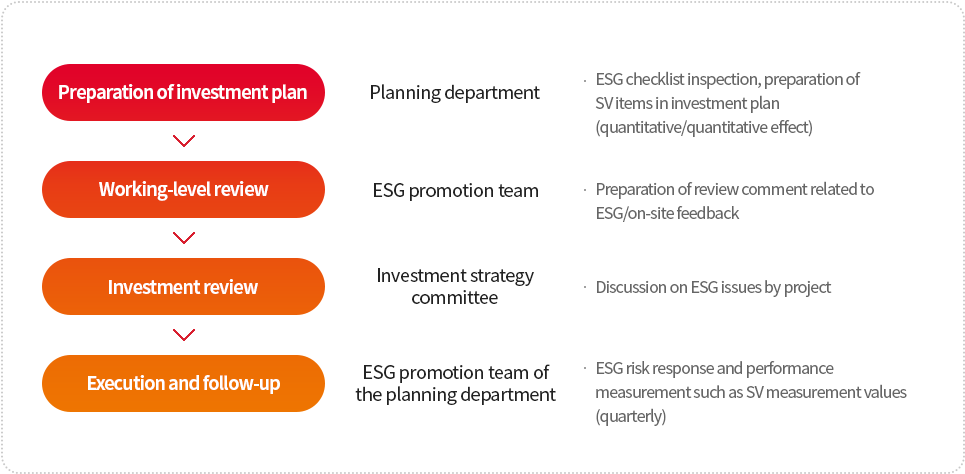

ESG-based New Business/Investment Activities

SK Specialty applies ESG standards to new business development and investment activities as part of ESG management activities. We have established and operates an investment portfolio deliberation policy which applies ESG standards, established management reporting and approval processes through the investment strategy committee, and stipulate new investments of 5/100 or more of the equity capital subject to the decision of the board of directors. In addition, we measure SV potential of new business/investment portfolio for decision making, and conduct SV impact measurement and performance monitoring afterwards. We plan to gradually expand new eco-friendly businesses and environment-related investments in consideration of external needs and stakeholders’ needs, including transformation to low-carbon society.

ESG Investment Review Process

ESG-based New Business/Investment Activity Objectives

SK Specialty takes into full consideration external needs including transformation to low carbon society, and plans to gradually expand new eco-friendly businesses and environment-related investments such as low GWP/waste resource upcycling products, CCUS development, etc.

Disclosure of ESG Information

SK Specialty published its first sustainable management report in 2021,

and will continue to disclose ESG information and publish reports by applying GRI and SASB/TCFD standards.

GRI

SK Specialty selects sustainable management issues according to the Global Reporting Initiative (GRI) standard,

which is an international guideline for sustainable management reporting, and discloses the information through the sustainable management report.

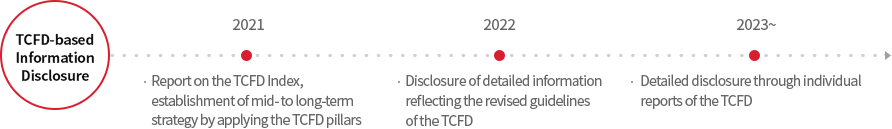

TCFD

SK Specialty discloses the information through the sustainable management report according to the disclosure recommendation

of the Task Force on Climate-related Financial Disclosure (TCFD).

It enhances management responsibilities through executive/board review and approval processes for TCFD disclosures.

SASB

SK Specialty discloses the information through the sustainable management report according to the chemical area indicators required by

the Sustainability Accounting Standards Board (SASB).

It enhances management responsibilities through executive/board review and approval processes for SASB disclosures.

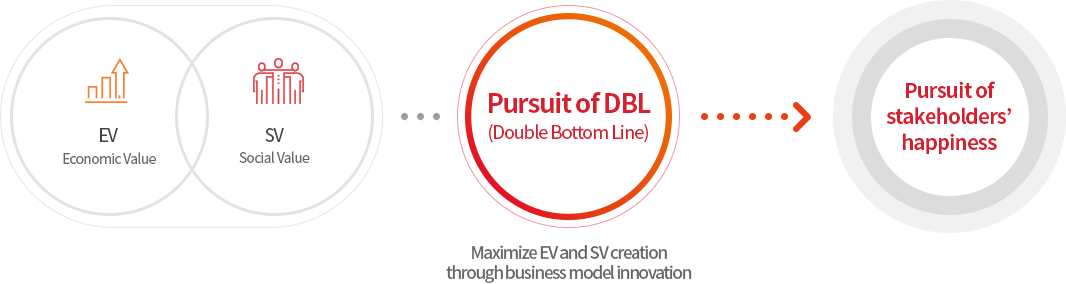

DBL Management

SK Group seeks the happiness of various stakeholders through DBL(Double Bottom Line) management

which aims to grow together with society by increasing social value (SV) along with economic value (EV).

SK Specialty is committed to driving business model innovation that maximizes the creation of economic

and social values at the same time in all management activities according to DBL management.

Social Value (SV) Measurement System

SK Group has developed and applied its own social value measurement index based on monetary value,

which is divided into indirect economic contribution performance, business social performance, and social contribution performance.

The measurement of ESG performance based on monetary value is a global trend,

and SK Group also plans to lead the global standardization of social performance measurement based on DLB management.

SK Specialty has been measuring social value according to this social value measurement methodology since 2018,

and has been working to increase the social value of each performance area as well as economic value after measurement.

| Indirect economic contribution performance (E) | ||||

|---|---|---|---|---|

| Employment | ||||

| Dividend | ||||

| Tax payment | ||||

| Benefits (new measurement) | ||||

| Environmental performance (E) | Product/Service | Resource Consumption |

Environment Contamination |

|

| Process | ||||

| Social performance (S) | Product/Service | Quality of life | ||

| Consumer protection | ||||

| Process | Labor | |||

| Shared growth | ||||

| Social contribution | Social contribution activities | |||

| Donation | ||||

| Volunteer activities | ||||

| Governance (G) | ※ Governance measurement methods are being studied/reviewed and will be reflected later | |||

Social Value (SV) Performance

Unit: KRW 100 Million

| Category | 2019 | 2020 | 2021 | |

|---|---|---|---|---|

| Social Value (SV) Performance Total | 1,081 | 1,176 | 1,096 | |

| Indirect economy | 1,261 | 1,335 | 1,216 | |

| Employment | 705 | 768 | 847 | |

| Dividend | 365 | 359 | Not occurring due to division | |

| Tax payment | 191 | 290 | 360 | |

| Benefits | - | - | 9 | |

| Environment* | △260 | △247 | △280 | |

| Society | 81 | 89 | 159 | |

| Labor/Shared growth* | 67 | 56 | 106 | |

| Social contribution | 14 | 33 | 53 | |

*Includes product and service performance