Financial Summary

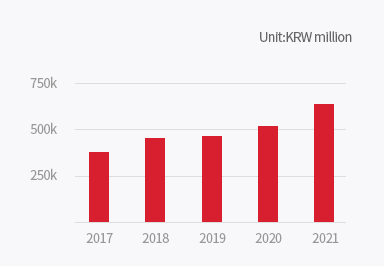

Sales

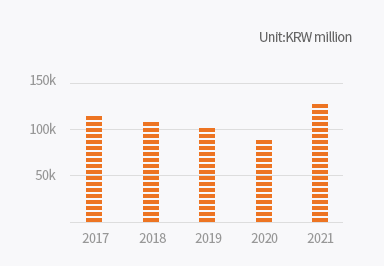

Operating Income

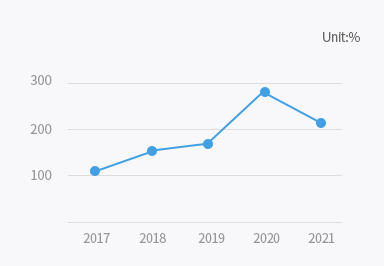

Liabilities Ratio

Income Statement

Unit:KRW million

| 2017 | 2018 | 2019 | 2020 | 2021 (Materials before division + New corporation) | |

|---|---|---|---|---|---|

| Sales | 374,284 | 444,873 | 454,649 | 520,073 | 622,894 |

| Operating Income | 113,884 | 105,669 | 98,897 | 91,159 | 121,191 |

| (%) | 30.43% | 23.75% | 21.75% | 17.53% | 19.46% |

| Net Income | 84,920 | 75,655 | 67,156 | 57,396 | 100,521 |

| EBITDA | 170,650 | 171,704 | 173,788 | 166,955 | 194,493 |

| (%) | 45.59% | 38.60% | 38.22% | 32.10% | 31.22% |

Balance Sheet

Unit:KRW million

| 2017 | 2018 | 2019 | 2020 | 2021 (Materials before division + New corporation) | |

|---|---|---|---|---|---|

| Current Assets | 127,123 | 134,679 | 177,166 | 180,513 | 204,905 |

| Non-Current Assets | 721,309 | 813,146 | 899,367 | 943,972 | 849,745 |

| Total Assets | 848,432 | 947,825 | 1,076,533 | 1,124,485 | 1,054,650 |

| Current Liabilities | 202,283 | 272,736 | 318,414 | 466,925 | 305,110 |

| Non-Current Liabilities | 243,024 | 304,663 | 354,119 | 360,448 | 408,538 |

| Total Liabilities | 445,307 | 577,399 | 672,533 | 827,373 | 713,648 |

| Total Shareholders’ Equity | 403,125 | 370,426 | 404,000 | 297,112 | 341,002 |

| Liabilities Ratio | 110.46% | 155.87% | 166.47% | 278.47% | 209.28% |

*based on Consolidated Financial Statement in accordance with K-IFRS

Credit Rating

Credit Rating Status by Rating Agency

| Rating Agencies | Ratings |

|---|---|

| NICE Investors Service | A+ |

| Korea Ratings | A+ |

| Korea Investors Service | A+ |

Definition of Domestic Corporate Bond Ratings

| Rating | Definition of Rating |

|---|---|

| AAA | Best ability to pay principal and interest |

| AA+/AA/AA- | The ability to pay principal and interest is very excellent, but it is somewhat inferior to AAA bonds |

| A+/A/A- | The ability to pay principal and interest is excellent, but it is more susceptible to deterioration of economic conditions and environments than the higher rating |

| BBB+/BBB/BBB- | The ability to pay principal and interest is good, but it involves the possibility that the ability to pay principal and interest in the future will decrease due to deterioration of economic conditions and environments compared to the higher rating |

| BB+/BB/BB- | The ability to pay principal and interest is not a problem right now, but it involves speculative factors that future safety cannot be guaranteed |

| B+/B/B- | Speculative due to lack of ability to pay principal and interest, and interest payments uncertain in times of recession |

| CCC | Unstable factors present regarding the payment of principal and interest, and very speculative due to a high risk of default |

| CC | More unstable factors than the higher rating |

| C | High risk of default and inability to repay principal and interest |

| D | Insolvent |

Audit Report

Appointment status of an external auditor

| Corporate | EY Hanyoung | Appointment date of the external auditor | 2022. 2. 10 |

|---|---|---|---|

| Period subject to audit | January 1, 2022 ~ December 31, 2024 (3 years) |

Recent audit comments | 2021 (unqualified opinion) |

Audit/Review Report

| 2023 | |

|---|---|

| audit report | Download |

| 2022 | |||

|---|---|---|---|

| Consolidated audit report | Download | audit report | Download |

| 1st quarter consolidated audit report | Download | 1st quarter audit report | Download |

| A half-year review report | Download | A half-year report | Download |

| A half-year consolidated review report |

Download | ||

Business Report

-

2022 / 1st period business report